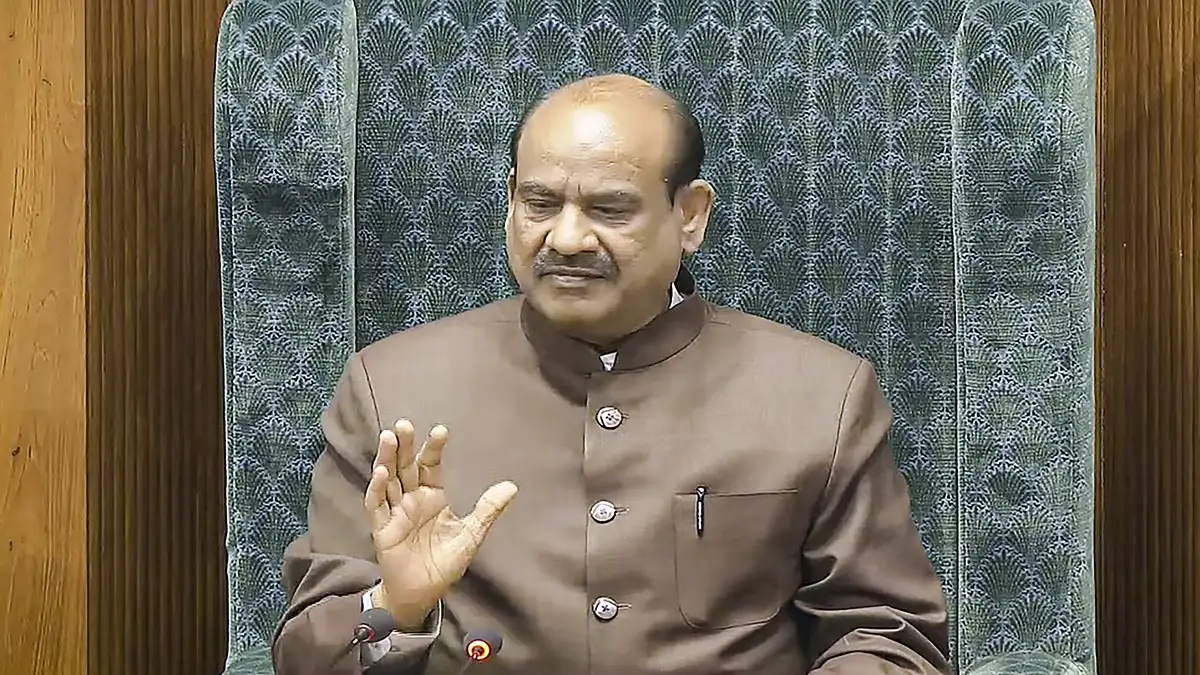

New Income Tax Bill: Lok Sabha Speaker Om Birla has constituted a Select Committee to examine the New Income Tax Bill, 2025. Senior Bharatiya Janata Party (BJP) leader and Odisha’s Kendrapara MP Baijayant Panda has been appointed as the Chairperson of the 31-member committee.

Notable names in the committee include BJP MP from Jharkhand Dr Nishikant Dubey, BJP MP from Karnataka Jagadish Shettar, BJP Rajasthan MP PP Chaudhary, Congress Haryana MP Deepender Singh Hooda, TMC West Bengal Mahua Moitra, NCP (SP) Maharashtra MP Supriya Suleamong others.

Check full list of members here:

New Income Tax Bill introduced in Lok Sabha

Earlier on February 13, Union Finance Minister Nirmala Sitharaman introduced the Income Tax Bill, 2025, in the Lok Sabha and urged Speaker Om Birla to refer it to a Select Committee for further examination. Opposition members opposed the Bill at the introduction stage, but the House approved its introduction through a voice vote. Following Sitharaman’s request, Speaker Birla appointed the Select Committee, which is expected to submit its report by the first day of the next session.

Here are some key points of New Income Tax Bill

- New Income Tax Bill seeks to replace 298 sections and 14 schedules in the six-decade-old voluminous legislation.

- The 622-page new law will be enshrined in 526 sections, 23 chapters and 16 schedules.

- The bill introduces a new concept of ‘tax year’ as the 12-month period beginning from April 1.

- The bill seeks to replace the present concept of assessment and the previous year.

- The new bill will come into effect from April 1, 2026, after it is vetted by Standing Committee and cleared by Parliament.

- The new bill has omitted redundant sections, like those relating to Fringe Benefit Tax.

- The bill is free from ‘explanations or provisos’, thereby making it easier to read and comprehend.

- The bill uses shorter sentences and has been made reader-friendly with the use of tables and formulae.

- Tables have been provided for provisions relating to TDS, presumptive taxation, salaries, and deductions for bad debt .

- The ‘Taxpayer’s Charter’ has been included in the Bill which outlines the rights and obligations of the taxpayers.

- The bill replaces the term ‘previous year’ as mentioned in the Income Tax Act, 1961 with ‘tax year’.

ALSO READ: New Income Tax Bill: From ‘tax year’ to special provision for capital gains computation, what’s new?