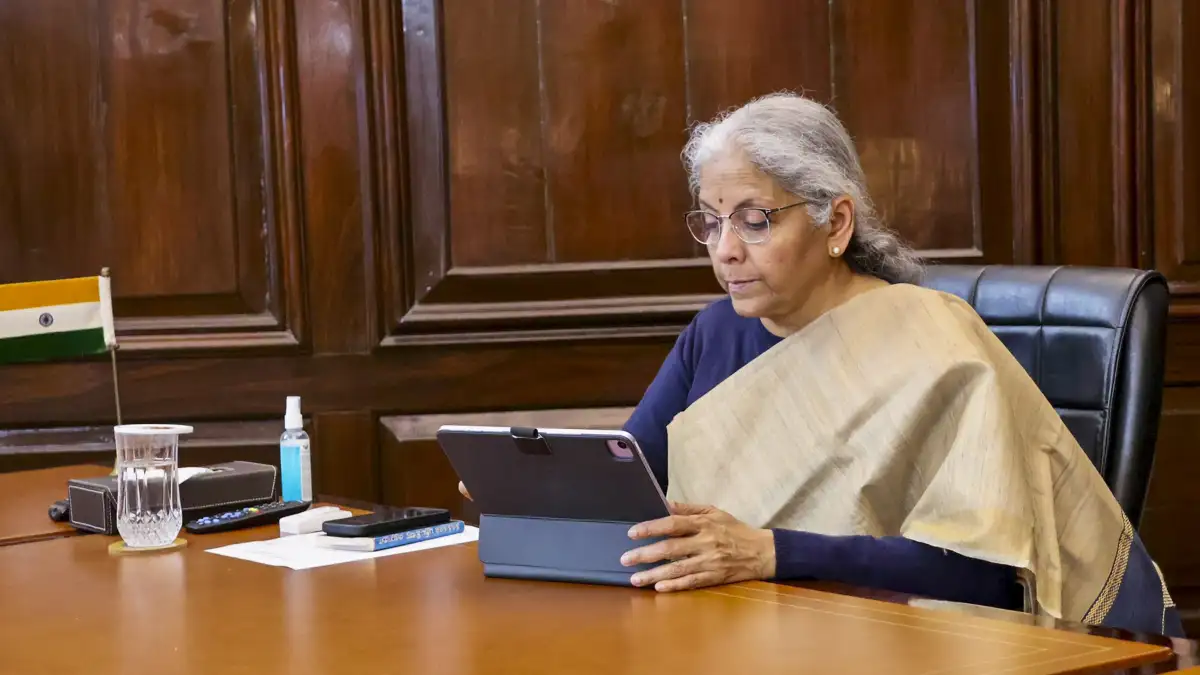

As Union Finance Minister Nirmala Sitharaman presented her eighth consecutive Union Budget on Saturday, all eyes are now on the items that have either become affordable or more expensive for consumers. In a big relief, FM Sitharaman said individual taxpayers earning up to Rs 12 lakh annually will not have to pay any income tax under the new tax regime as the government gave relief to middle class by raising exemption limit and rejigging slabs.

She said for salaried employees, this nil tax limit will be Rs 12.75 lakh per annum, after taking into account a standard deduction of Rs 75,000.

This time, the Union Budget 2025 introduced several changes to customs duty, benefiting various sectors. From medicine to industrial goods, several proposals aim to provide relief and boost growth in critical sectors, as well as the items that will now become costlier.

List of items that got cheaper

- Cancer, chronic diseases medicines – 36 life saving drugs fully exempted from basic custom duties.

- Electronic Goods – There will be reduction of BCD (basic customs duty) to 5 per cent for open cells and other components.

- Cobalt powder and waste, scrap of lithium-ion battery, Lead, Zinc and 12 more critical minerals are exempted from Basic Customs Duty (BCD).

- Over 35 additional goods for EV battery manufacturing, and 28 additional goods for mobile phone battery manufacturing added to list of exempted capital goods.

- Wet Blue leather will be fully exempted from Basic Customs Duty

- Moreover, BCD on Frozen Fish Paste (Surimi) to be reduced from 30 per cent to 5 per cent for manufacture and export of its analogue products

Items that got costlier

- Even as several essential items will see a reduction or exemption in customs duties, some goods are set to become costlier, particularly in the tech and manufacturing sectors.

- The Centre proposed to increase the Basic Customs Duty on interactive flat-panel displays from 10% to 20%.

- The Centre introduced a time limit of two years for provisional assessments, which will ensure quicker and more efficient customs clearance for businesses. This change will impact certain industries dealing with imports and exports.