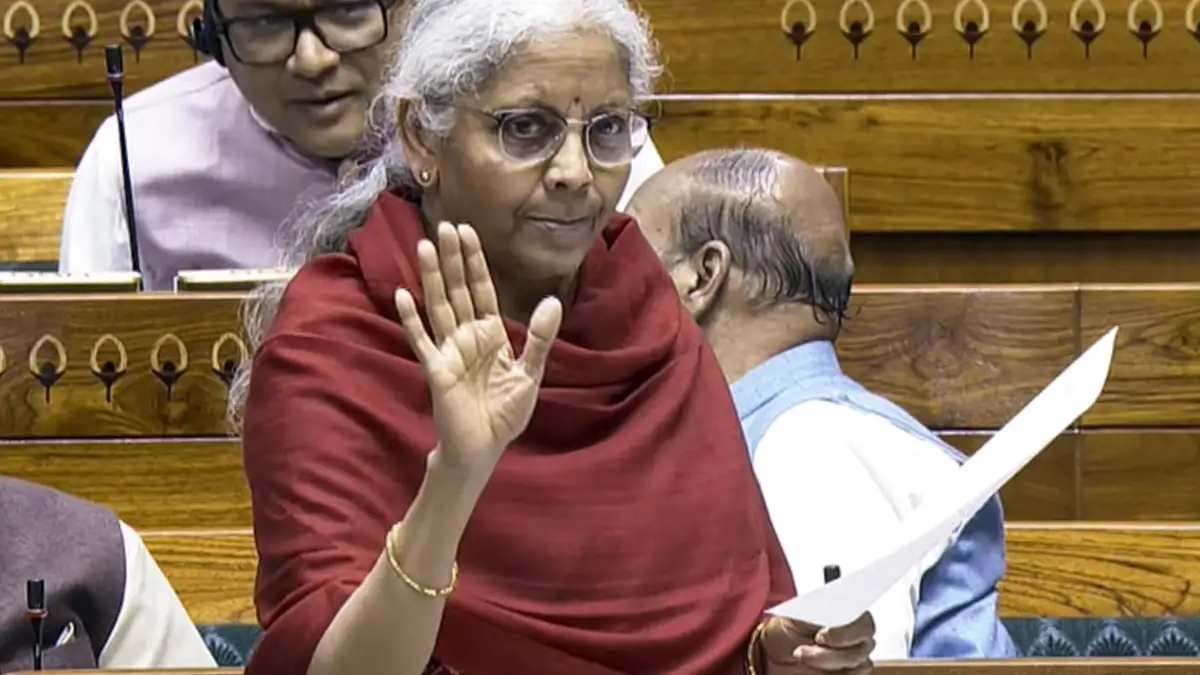

Union Finance Minister Nirmala Sitharaman on Thursday presented the New Income Tax Bill in the Lok Sabha. The bill aims to consolidate and amend the existing income-tax laws in order to bring potential changes to the country’s tax framework.

The proposed legislation is expected to streamline tax regulations, enhance compliance, and possibly introduce new provisions in line with evolving economic policies. The move comes as part of the government’s broader efforts to modernise and simplify the taxation system.

The new Income Tax Bill will replace the six-decade-old Income Tax Act of 1961. The Income Tax Bill, 2025 comprises 536 sections, higher than 298 sections of the current Income-Tax Act, 1961. The existing law has 14 schedules which will increase to 16 in the new legislation.

However, the number of chapters has been retained at 23. The number of pages has been reduced substantially to 622, almost half of the current voluminous Act which includes amendments made over the last six decades. When the Income Tax Act, 1961, was brought in, it had 880 pages.

The proposed law replaces the term ‘previous year’ with ‘tax year’. Also, the concept of assessment year has been done away with. Currently, for income earned in the previous year (say 2023-24), tax is paid in the assessment year (say 2024-25). This previous year and assessment year concept has been removed and only tax year under the simplified bill has been brought in.