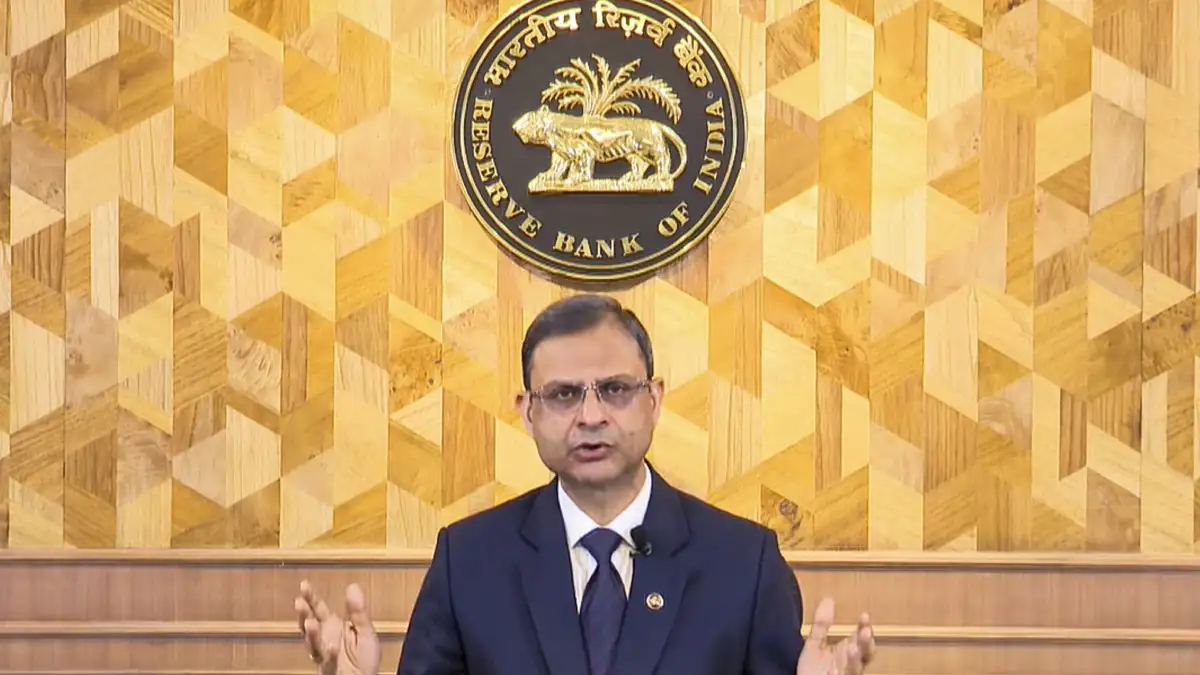

During his inaugural Monetary Policy Committee meeting today, the Reserve Bank of India’s new Governor, Sanjay Malhotra, has announced a 25 basis points reduction in the repo rate. This is the first rate cut in nearly five years.

“The Monetary Policy Committee unanimously decided to reduce the policy rate by 25 basis points from 6.5 per cent to 6.25 per cent,” he said.

The last revision of rates happened in February 2023 when the policy rate was hiked by 25 basis points to 6.5 per cent.

Also, the Standing Deposit Facility (SDF) rate is 6 per cent and the Marginal Standing Facility (MSF) rate is 6.50 per cent.

Malhotra said the flexible inflation targeting framework has served the Indian economy well. “Average inflation has been lower since this framework was out in place,” he added.

Governor Sanjay Malhotra also said the flexible inflation targeting framework has served the Indian economy well. “Average inflation has been lower since this framework was out in place,” he added.

Besides, the government has bettered its fiscal deficit projections for the current fiscal as well as the next. The fiscal deficit for FY25 has been pegged at 4.8 per cent of GDP, lower than budgeted 4.9 per cent, while for FY26 the deficit is projected at 4.4 per cent, lower than what was given in the consolidation roadmap.

The MPC noted inflation has declined, supported by a favourable outlook on food, and will further moderate in FY26. Malhotra also noted that economic activities are expected to improve in the current year and agricultural activities remain upbeat. He also said that manufacturing activity is expected to recover gradually in the second half of the year.

He also raised concerns about the rise in digital fraud and said that it warrants actions by all stakeholders.

“RBI has been taking various measures to enhance digital security in banking and payment systems. To extend the additional authentication factor to international digital payments to offshore merchants. I would urge banks and NBFCs to continuously improve preventive and detective controls to mitigate cyber risks,” he said.

In order to keep a tab on such frauds, Malhotra said that banks will have exclusive domain name ‘fin.in’ and registration for this will start in April.