Usually, banks issue chequebooks to savings account holders. Banks issue cheques to both current account holders and savings account holders. In this era of UPI and digital transactions, the importance of cheques has not ended. Therefore, people prefer to use cheques in big transactions. Cheques are considered proof of transactions. You too must have given money to someone through a cheque many times. Do you know that there are 9 types of bank cheques? Let us know where and when which cheque is used.

Bearer cheque

A bearer cheque is a cheque that can be cashed by the person whose name appears on the cheque. A bearer cheque is also called a ‘payable to bearer’ cheque.

Order check

An order check is a check that has “or to order” written after the payee’s name. It is also called a “payable to order” check.

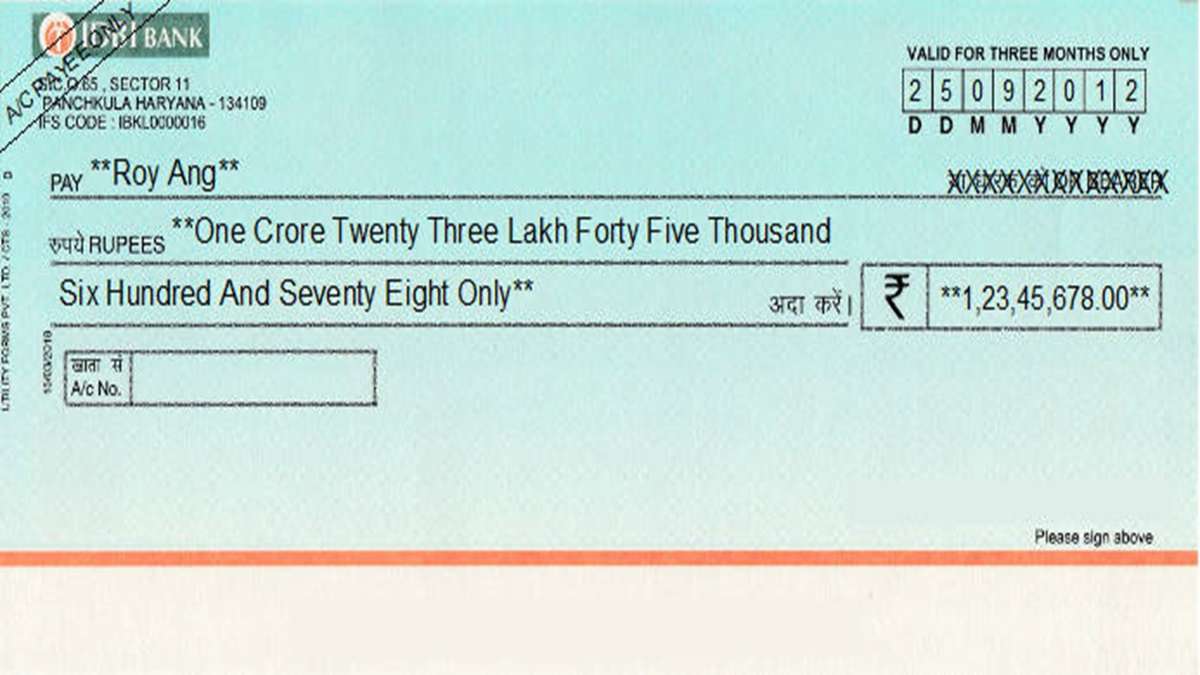

Crossed cheque

In a crossed cheque, the cheque issuer makes two parallel lines at the top of the corner of the cheque, whether it is a cheque or not, by writing “a/c payee”. This ensures that no matter who presents the cheque at the issuer’s bank, the transaction will happen in the account of the person named in the cheque. The advantage of a crossed cheque is that it reduces the risk of money being given to an unauthorized person.

Open Check

Open cheques are sometimes also called uncrossed cheques. Any cheque that has not been crossed falls under the open cheque category. This cheque can be presented to the drawer’s bank and is payable to the person presenting it.

Post-dated cheques

A cheque bearing a date later than the date of actual issue is called a post-dated cheque. This cheque can be presented to the drawer’s bank any time after it is issued, but funds are not transferred from the payee’s account until the date stated on the cheque.

Stale Check

This is a cheque whose validity period has expired and cannot be encashed now. Initially, this period was six months from the date of issue. Now this period has been reduced to three months.

Traveller’s cheques

It can be considered equivalent to a universally accepted currency. Traveller’s cheque is available almost everywhere and comes in various denominations. It is a cheque issued by a bank to make payments from one place to another. Traveller’s cheque has no expiry date and can be used during your next trip as well. You also have the option of encashing it after you return from your trip.

Self Check

When a person issues a cheque to himself, it is usually called a self-cheque. It has the word “self” written in the name column. A self-cheque is drawn when the drawer wants to withdraw money in cash from the bank for his own use.

Bankers cheque

A banker’s cheque is a cheque issued by a bank on behalf of the account holder to another person in the same city with an order to pay a specified amount of money.