Whether it is for opening a bank account or making an investment in a mutual fund, first thing that is needed is a KYC (Know Your Customer). Banks take all the documents from customers for this process. Under the KYC process, a customer has to provide Aadhar, PAN and other relevant documents.

If you want to avoid this hassle, then follow an easy process to get a CKYC number. after getting this number, you will get rid of the of getting KYC done again and again. The banks are providing this facility.

What is CKYC?

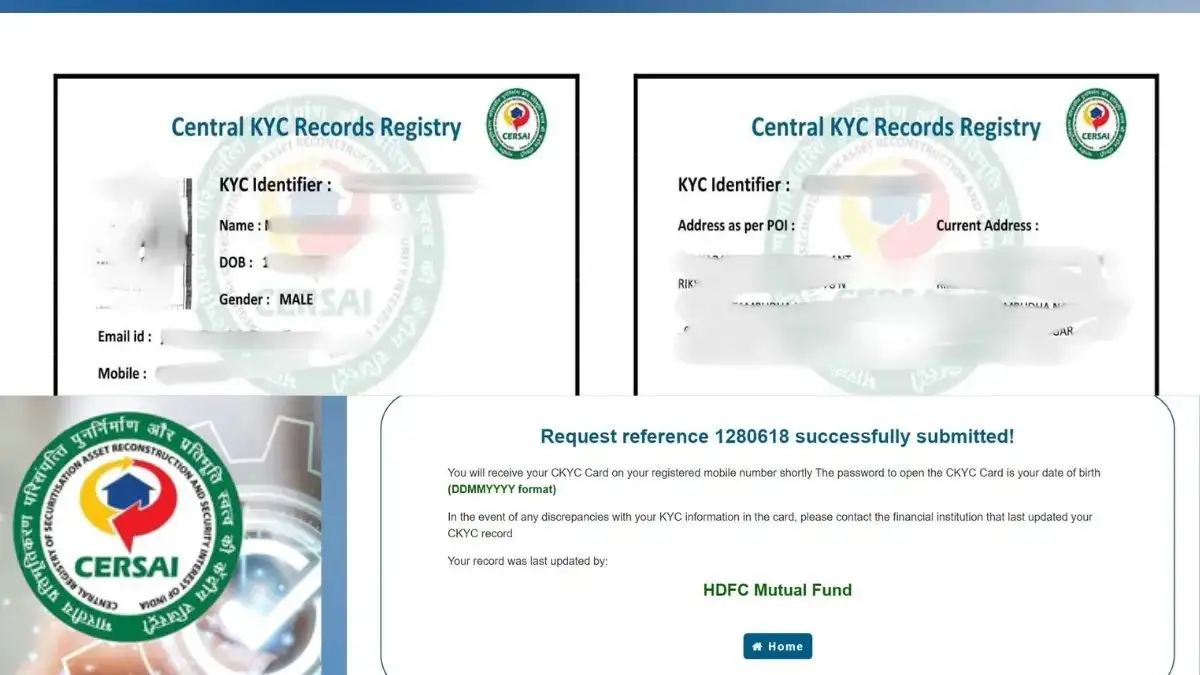

CKYC is a unique 14 digital number that is linked to your identity so that all identity documents can be easily accessed. It accesses the information from a centralised database in India that stores KYC information of customers. The Central Registry of Securitisation Asset Reconstruction and Security Interest (CERSAI) is a body under the Government of India that acts as a centralized repository for KYC records.

Simply put, it is like a secure digital vault for the identity and personal information. Resultantly, when a person wants to open an account or make an investment, they do not have to go through the KYC process every time. Banks could take the information they need through CKYC.

Benefits of CKYC

- No KYC requirement for opening a bank account or starting a new investment every time.

- CKYC data can be updated as and when required.

- Single CKYC number for different financial instruments like insurance, mutual funds and stock markets.

- Quick and secure verification

- Helps in speedy financial processes

How to create your CKYC?

- Go to any financial institution (banks, insurance companies, mutual funds and other financial institutions) registered with CKYC.

- Submit the required documents like PAN card, Aadhaar card and address proof.

- The financial institution will verify your documents with the issuing authorities.

- After successful verification, you will get a unique 14-digit CKYC number.

How to check your CKYC number?

- Visit the link: https://www.ckycindia.in/kyc/getkyccard.

- Enter your registered mobile number and captcha.

- Click on Next and get an OTP on RMN.

- Enter the OTP and receive a link on RMN.

- Use the link to download your CKYC card.

- The PDF will be password protected. The password will be your date of birth in DDMMYYYY format.